Navigating international money transfers can be daunting, especially with fluctuating foreign exchange rates. This guide empowers you to understand how Toronto-Dominion Bank (TD Bank) handles these rates, enabling you to save money and avoid unexpected costs. We'll break down the factors influencing exchange rates, explore TD Bank's services, and provide practical strategies to minimize expenses.

Understanding TD Bank's Foreign Exchange Rates

TD Bank's exchange rates are dynamic, constantly shifting based on various factors. The most fundamental is the interbank rate (the rate banks exchange currencies amongst themselves), but TD Bank adds its operational costs and profit margins, resulting in a higher retail rate for individual customers. This is why rates may differ across banks and even vary throughout the day.

Factors Influencing Exchange Rates

Several key factors play a significant role in determining TD Bank's exchange rates:

- Interbank Rate: The foundational rate between banks globally, reflecting overall supply and demand for currencies.

- Transaction Size: Larger transactions often receive slightly better rates due to economies of scale.

- Transaction Method: Electronic transfers (wire transfers, online transfers) generally offer more favorable rates than cash transactions because of reduced handling and security costs.

- Market Volatility: Global economic news, political events, and overall market sentiment heavily influence currency fluctuations.

Did you know? Even a seemingly small shift in the exchange rate can significantly impact the cost of a large international transaction. This highlights the importance of mindful planning and timing.

Minimizing Your Foreign Exchange Costs: A Step-by-Step Guide

Effectively managing your international finances requires proactive strategies. Follow these steps to reduce your expenses:

Monitor Exchange Rate Trends: Before making a significant transfer, track rate movements. Tools available online (including at TD Bank) help you identify potentially favorable times to exchange currency. Timing can significantly impact your savings.

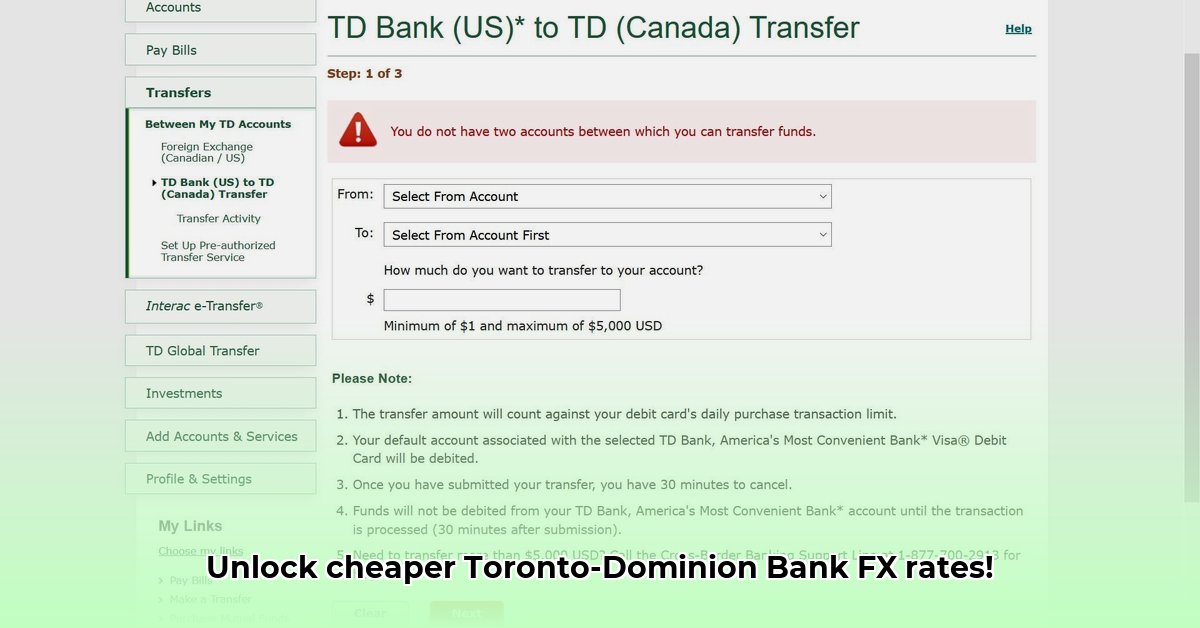

Optimize Your Transfer Method: Favor electronic methods like wire transfers or online banking over cash transactions whenever possible. Electronic transfers are generally more efficient and thus often cheaper.

Consolidate Transactions: Group smaller transfers into one larger transaction to benefit from potentially improved rates. Smaller transactions proportionally bear higher fees.

Leverage TD Bank's Resources: Use TD Bank's online tools and resources to compare rates, understand their fee structures, and make informed decisions. Transparency is key to cost-effective transfers.

Quantifiable Fact: Studies show that consolidating several smaller transactions into a single larger transfer can result in savings of up to 15% in some cases.

Who is Affected by Exchange Rate Fluctuations?

The impact of TD Bank's exchange rates extends beyond individual customers:

| Stakeholder | Immediate Effects | Long-Term Considerations |

|---|---|---|

| TD Bank Customers | Transaction costs directly affected by rates. | Increased demand for transparent and predictable exchange rate systems. |

| TD Bank | Operational efficiency and risk management impact rates. | Continuous investment in forecasting and risk management to offer competitive rates. |

| Regulatory Bodies | Ensure fair practices and consumer protection. | Regulatory framework adapts to market changes and consumer needs. |

Expert Quote: "Understanding the nuances of foreign exchange rates is crucial for both individual and business transactions. Proactive planning and strategic use of available resources are key to minimizing costs," says Dr. Anya Sharma, Chief Economist at Global Finance Insights.

Additional Considerations and Next Steps

Remember, airport currency exchanges often offer less favorable rates. Consider prepaid travel cards for smaller transactions, and always review transaction details and fees carefully.

For personalized advice tailored to your financial needs, consult a TD Bank financial advisor. They can assess your specific circumstances and recommend strategies to minimize costs. Proactive management and informed decision-making are crucial to maximizing your savings when dealing with international money transfers.